News

Will stablecoins disrupt or integrate with traditional payment systems?

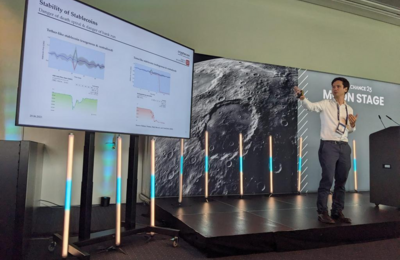

Matthias Hafner's presentation on May 23, 2025 at the ETHBratislava 2025 conference, explored the evolving relationship between stablecoins and established payment giants like Mastercard and Visa. The talk examined whether stablecoins will eventually replace these networks, or if a more integrated future awaits.

It delved into the complexities of current payment schemes and highlighted how stablecoins offer a simpler transaction flow, while also discussing the existing challenges and potential for future disruption or integration within the financial landscape.

You can find the presentation here.

Last week, the Center for Cryptoeconomics had the privilege of attending EthereumZürich Conference 2025!

We presented our latest research on the Ethereum staking market, hosted a booth (complete with mulled wine), attended many interesting talks, and had insightful discussions with both familiar and new faces from the community.

In their talk, Matthias Hafner and Nicolas Oderbolz, explored how different forms of staking—solo staking, liquid staking, and staking via centralized exchanges—may be affected by a reduction in Ethereum protocol issuance. By analyzing their revenue sources and cost structures and integrating these insights into a formal model, we aim to contribute to the ongoing discussion on the future development of the Ethereum staking protocol. More to come!

You can find the presentation here.

The paper "The Four Types of Stablecoins: A Comparative Analysis" has been accepted and published in Ledger Journal.

The publication titled "The Four Types of Stablecoins: A Comparative Analysis" by Matthias Hafner, Marco Henriques Pereira, Helmut Dietl and Juan Beccuti has recently been published in Ledger Journal.

Abstract: Stablecoins have gained significant popularity recently, with their market cap rising to over $180 billion. However, recent events have raised concerns about their stability. In this paper, we classify stablecoins into four types based on the source and management of collateral and investigate the stability of each type under different conditions. We highlight each type’s potential instabilities and underlying tradeoffs using agent-based simulations. The results emphasize the importance of carefully evaluating the origin of a stablecoin’s collateral and its collateral management mechanism to ensure stability and minimize risks. Enhanced understanding of stablecoins should be informative to regulators, policymakers, and investors alike.

The paper is freely accessible at Ledger.

Nicolas Greber and Dr. Nicolas Eschenbaum gave a presentation on how arbitrageurs can exploit forks on DAOs and presented possible solutions to the problem.

At the CV Summit 2024, Nicolas Eschenbaum and Nicolas Greber presented possible strategies for DAOs in dealing with arbitrage in decentralised organisations based on their research. Using the example of the Noun DAO, they showed how the introduction of a forking mechanism -intended as a contribution to decentralisation and protection against majority attacks- instead opened up an arbitrage opportunity for speculators. Governance mechanisms that allow members of a DAO indirect access to the treasury harbour significant risks. For the specific example of the Nouns DAO, Nicolas Eschenbaum and Nicolas Greber presented possible solutions and their challenges to prevent speculators from participating in the DAO.

You can find the presentation here.

A new publication is available now at arxiv.org.

The publication titled Towards an Optimal Staking Design: Balancing Security, User Growth, and Token Appreciation by Nicolas Oderbolz, Matthias Hafner and Beatrix Marosvölgyi has recently been published in the ChainScience Conference Proceedings.

This paper examines the economic and security implications of Proof-of-Stake (POS) designs, providing a survey of POS design choices and their underlying economic principles in prominent POS-blockchains. The paper argues that POS-blockchains are essentially platforms that connect three groups of agents: users, validators, and investors. To meet the needs of these groups, blockchains must balance trade-offs between security, user adoption, and investment into the protocol.

The authors focus on the security aspect and identify two different strategies: increasing the quality of validators (static security) vs. increasing the quantity of stakes (dynamic security). They find, that the optimal staking design hinges upon a platform's specific objectives and its developmental stage. This research compels blockchain developers to meticulously assess the trade-offs outlined in this paper when developing their staking designs.

The whole paper can be accessed at the webpage of the Conference Proceedings or here.

The Center for Cryptoeconomics receives a research grant through the cyber.Fund MVI Grants Program.

In order to limit the growth of stakes in the Ethereum ecosystem to inefficiently high levels, recent discussions in the community have focused on the idea of changing the Ethereum issuance curve. However, the potential secondary effects of such a change are underexplored. In particular, a reduction in staking rewards may risk undermining the degree of decentralization of the Ethereum validator set. The research team at the Center for Cryptoeconomics aims to provide some clarity in this regard. We do so by evaluating the potential effects that changes in the issuance curve may have on different types of stakers, in particular solo stakers.

You can find the grant announcement of cyber.fund and a more detailed description here.

Beatrix Marosvölgyi and Matthias Hafner delivered a joint presentation discussing the sustainability journey of Ethereum. The title of their presentation: The Green Evolution of Ethereum.

The presentation focused on how Ethereum has reduced its energy consumption and carbon footprint, also considering the impact of the latest Dencun upgrade. In addition, the presentation explained the methodology used to assess the environmental impact of products and services (Life Cycle Assessment) and gave an outlook on what else could be improved on Ethereum in the future from a sustainability perspective.

You can find the presentation slides here and the video of the presentation here.

In his presentation titled "Next-Gen Payments: Competition among Stablecoins, CBDCs, and other Payment Tokens", Matthias Hafner discussed the competition that is developing between various upcoming digital payment methods, including stablecoins and central bank digital currencies (CBDCs).

His talk explored three key areas: 1) the current landscape of value transfer using low-volatility assets and the motivations behind such transactions; 2) emerging methods and motivations for value transfer on Ethereum; and 3) an examination of future value transfer mechanisms through the lens of competition economics, considering the evolving roles of stablecoins, CBDCs, and real-world assets.

You can find the presentation slides here and the video of the presentation here.

Nicolas Oderbolz presented the paper "Towards an Optimal Staking Design: Balancing Security, User Growth, and Token Appreciation", which he wrote with co-authors, Matthias Hafner and Beatrix Marosvölgyi.

The paper explores the economic and security aspects of Proof-of-Stake (POS) designs, focusing on the balance between security, user adoption, and investment. It identifies a trade-off between enhancing the quality of validators and increasing the quantity of stakes, suggesting that the optimal POS system design depends on a blockchain's specific objectives and developmental stage.

Link to the slides: Towards an Optimal Staking Design Presentation

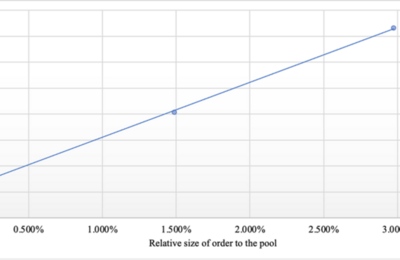

In a series of blog post we discuss and compare the different versions of the decentralized exchange platform, Uniswap.

In the first blog post, our Expert fellow, Thunj Chantramonklasri explains the basic terms in connection with Uniswap's design, to be able to build on these terms in his upcoming articles. He also elaborates on the mathematical background of the impermanent loss problem.

You can find the whole publication and our Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Matthias Hafner presented his research on the impact of arbitrageurs on decentralized exchanges at the Research Track of the Crypto Finance Conference in St. Moritz.

Matthias presented his research paper "Impermanent Loss Conditions: An Analysis of Decentralized Exchange Platforms".

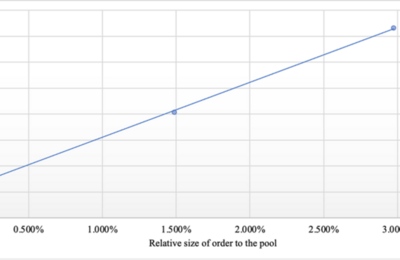

Abstract: Decentralized exchanges are widely used platforms for trading crypto assets. The most common types work with automated market makers (AMM), allowing traders to exchange assets without needing to find matching counterparties. Thereby, traders exchange against asset reserves managed by smart contracts. These assets are provided by liquidity providers in exchange for a fee. Static analysis shows that small price changes in one of the assets can result in losses for liquidity providers. Despite the success of AMMs, it is claimed that liquidity providers often suffer losses. However, the literature does not adequately consider the dynamic effects of fees over time. Therefore, we investigate the impermanent loss problem in a dynamic setting using Monte Carlo simulations. Our findings indicate that price changes do not necessarily lead to losses. Fees paid by traders and arbitrageurs are equally important. In this respect, we can show that an arbitrage-friendly environment benefits the liquidity provider. Thus, we suggest that AMM developers should promote an arbitrage-friendly environment rather than trying to prevent arbitrage.

Find the paper here.

In our next blog post, we explore some potential use cases of blockchain and AI in the aviation industry.

The continuous developments in blockchain and artificial intelligence enable users to apply these technologies in versatile ways across various industries. In this article, we examine the potential of both technologies in four aviation-related areas: ground operations, customer-related activities, maintenance, repair, and overhaul activities (MRO), and airport infrastructure-related services. We showcase, through a handful of real-life examples, how these technologies can not only increase efficiency but also reduce costs and enhance the travel experience.

You can find the whole publication and our Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

In this final blog post in our series on crypto staking, we summarize and comment on our findings and discuss the economic trade-offs of different staking policy choices.

This blog post is the last of our Crypto-Staking Blog Series. We summarize and comment on our findings and discuss the economic trade-offs of different staking policy choices. You can find the first post on the economics of crypto staking here and the second post, with an economic comparison of staking across blockchains, here. You can find the whole publication and our Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Our paper on DeFi lending risks, authored by Alberto Arrigoni, Benedetto Biondi, Nicolas Greber, Matthias Hafner, Gidon Katten, Romain de Luze, Michelangelo Riccobene, and Juan Ignacio Beccuti Vazquez was called as one of the best papers in 2023, published in the Journal of British Blockchain Association.

We are delighted that the paper has received this award from The British Blockchain Association! This recognition is a testament to the hard work, dedication and expertise of the author team from Folks Finance and the Center for Cryptoeconomics. According to the British Blockchain Association, papers with the following characteristics are rewarded:

- Likely to influence future thinking

- Have made, or have the potential to make a significant contribution to the DLT/ Blockchain or Cryptocurrencies ecosystem, as measured by scholarly and societal impact metrics, downloads, article views, engagement on social media (Alternative metrics) or citation in policy documents

- Are cited or have the potential to be cited at high-impact conferences and events, or referenced or quoted by policymakers, influencers or thought-leaders in the field

You can read the paper here and find more about the British Blockchain Association here.

The TRUST SQUARE in Zurich hosted an exciting evening of discussion and learning centered around decentralized autonomous organizations (DAOs). The event, co-organized by DAO Suisse, featured an insightful presentation on DAO Economics by the Cryptecon team.

Cryptecon team members Nicolas Eschenbaum, Beatrix Marosvölgyi, and Nicolas Oderbolz shared their insights on tokenomics and platform economics. Their presentation ignited a thought-provoking discussion with attendees, delving into the potential and challenges facing this innovative organizational model.

The collaborative atmosphere, fueled by Cryptecon's expertise, highlights a growing interest in the potential of DAOs to transform how we work and organize.

Swiss Economics and the Center for Cryptoeconomics conducted a survey on IP and Blockchain for the Swiss Federal Institute of Intellectual Property. The results are now published.

Intellectual property, such as patent rights or copyrights, protects inventors from free riders and, as a result, creates incentives to invest more in research and development as well as in creative works. IP is also relevant in the rapidly evolving field of blockchain technology and its applications. Through our study, the IPI aimed to gain a better understanding of the current and, above all, the future demand for IP services. A similar country-specific study is currently underway in Singapore and will be published later.

The study's findings will be presented by Matthias Hafner and Delia Horst (representative of the IPI) on October 3rd at the CV Summit event in Zug.

Authors: Dr. Samuel Rutz, Matthias Hafner, Felix Wüthrich, Beatrix Marosvölgyi

You can find our study published on the IPI website here (only available in EN).

We are happy to announce a new collaboration between the Center for Cryptoeconomics and the Consensus Group Australia.

Our partnership with Consensus Group Australia and CEO Nathan van den Bosch, who is a Blockchain Expert and Behavioral Economist aims to foster a strong relationship, where both entities can join forces to share their skills and expertise. We welcome Nathan’s valuable skills and expertise to our organization.

More about the Consensus Group Australia

More about Nathan Van den Bosch

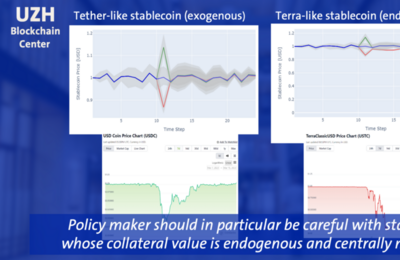

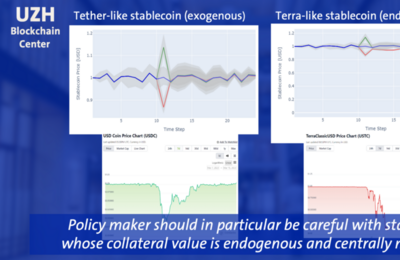

In a recent presentation at the Blockchance conference in Hamburg, Matthias Hafner explored the factors that influence the stability of stablecoins and discussed how they relate to recent developments in CBDCs and the tokenization of real-world assets.

Drawing from recent literature, including his own research conducted at the University of Zurich, Matthias Hafner emphasized that the construction and management of collateral are key determinants of stablecoin stability. While externally derived collateral value may compromise the independence of the stablecoin ecosystem, collateral value derived from within the ecosystem carries the risk of death spirals, as observed with TerraUSD. Additionally, centralized management may offer cost-effectiveness but exposes the stablecoin ecosystem to the risk of bank runs, as exemplified by the recent USDC depeg incident.

Further, Matthias Hafner argued that the advent of CBDCs and tokenized real-world assets could potentially put pressure on the demand for stablecoins in the future. This could, for example, result in the need to introduce solutions for stablecoins that offer interest payments based on their underlying collateral.

More detailed information can be found here:

Blockchance presentation slides

Matthias Hafners research on stablecoins

We are pleased to announce that Nicolas Oderbolz has been promoted to the position of Economist.

Nicolas Oderbolz has joined Swiss Economics and the Center for Cryptoeconomics as an Economist with a focus on regulation, health and blockchain. He is involved in various projects in the fields of energy, data analytics and cryptoassets.

Nicolas completed his Bachelor and Master studies in Economics at the University of Zurich, with a focus on empirical methods and data analysis. During his studies, he worked as a research assistant at the University of Zurich in the field of labour and development economics. He has been a valuable part of the Swiss Economics team since the summer of 2022.

We congratulate him and wish him much success and joy in his new activities for Swiss Economics and for the Center for Cryptoeconomics.

The article "Blockchain und ihre Anwendungen" by Matthias Hafner and Dr. Christian Jaag was recently published in the quarterly issue of the zsis) Centre for Swiss and International Tax Law.

In their contribution, they explain how blockchain works through illustrative examples and use cases. In addition, they explain the legal classification of crypto-assets and show the limits of the technology.

The publication can be accessed here.

A new collaboration has been established between the Center for Cryptoeconomics and the team of the Raremind platform to connect Web2 chess players with a Web3 gaming experience.

The Center for Cryptoeconomics collaborates with the team of Raremind to create a Web3 platform, that can be connected with Web2 chess platforms, to utilize points earned on the platforms in the form of crypto-rewards and real-world rewards. The Play-to-Earn platform is not only a bridge between existing online chess-platforms, but it will also offer a Learn-to-Earn mode and Fantasy Leagues, to predict the outcomes of real-world chess tournaments. The Center for Cryptoeconomics assists the project and reviews the creators' most important tokenomic decisions.

To access the platform and join their upcoming tournaments, click here:

raremind.com

Matthias Hafner presented his research on stablecoins at the Wolfram ChainScience conference in Boston, USA.

The article, "The Four Types of Stablecoins: A Comparative Analysis" (jointly with Marco Henriques Pereira, Prof. Dr. Helmut Dietl, and Juan Beccuti) discusses the conditions under which stablecoins may lose their value. Among others, they explore the crash of Terra and the de- and re-peg of the USDC stablecoin.

Link to the slides: The Four Types of Stablecoins (swiss-economics.ch)

The Center for Cryptoeconomics has partnered with CADLabs and Bumper to evaluate the Bumper DeFi Protocol. We are excited to announce that our findings have now been published in the Bumper Simulation Report.

The simulations conducted as part of the collaborative research effort were able to validate the design of the Bumper protocol. The findings highlight that Bumper provides more affordable premiums and superior returns when compared to similar offerings. Further, we demonstrate Bumper's capacity to sustain solvency and generate revenue from administering usage fees.

You can find the publication here.

Matthias Hafner was awarded 1st place at The British Blockchain Association for their research on Stablecoin (joint work with Prof. Helmut Dietl)

In this research, the authors explained the recent depeg of the second largest stablecoin USDC and under what conditions stablecoins could lose their value.

The slides can be found here: The Four Types of Stablecoins: A Comparative Analysis.

In less than a week, the Shanghai-update will be implemented on the Ethereum Beacon Chain. In a series of blog post we discuss and compare staking designs of different blockchains.

In our second blog post of this series, we analyze and compare the staking designs of different blockchains from an economic perspective. To make the information more accessible and compact, we also created a table which can serve as a quick reference.

You can find the whole publication and our new Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

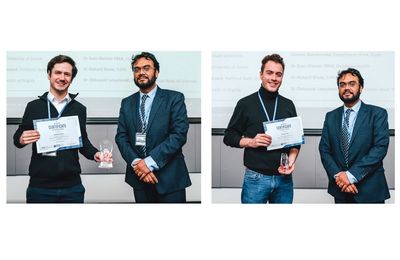

Matthias Hafner and Nicolas Greber were awarded first and third place at BBA's 5th Scientific Conference for their research presentations.

Matthias Hafner and Nicolas Greber, two of our blockchain researchers, have made their mark at BBA's 5th Scientific Conference, with first and third place awards for their research presentations.

Matthias explained the recent depeg of the second largest stablecoin USDC and under what conditions stablecoins could lose their value. The paper and slides were created in collaboration with Marco Henriques Pereira, Juan Beccuti and Helmut Dietl.

Nicolas proposed mechanisms for handling liquidity risk using the DeFi lending platform Folks Finance. The paper and slides are the result of joint work with Matthias Hafner, Romain de Luze, Juan Becutti, Benedetto Biondi, Gidon Katten, Michelangelo Riccobene, and Alberto Arrigoni.

More about the British Blockchain Association.

In light of the Shanghai update of the Ethereum blockchain, which allows stakers to unstake their ETH, we find it timely to investigate crypto staking in a series of upcoming blog posts.

In our first blog post, we explain the basic terms, economics and mechanisms of staking designs. Later, we compare the staking designs of seven different blockchains.

You can find the whole publication and our new Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Matthias Hafner was featured on an episode of the X goes Crypto podcast. In the podcast, he delves into the topic of tokenomics, sharing his expert insights and analysis on the current state of the industry.

In this X goes Future Talk episode, Fabian from X goes Crypto interviews Matthias Hafner, an expert in the crypto space for years and also Director of the Center for Cryptoeconomics from Switzerland. The Center for Cryptoeconomics provides economic research and consulting services related to blockchain technology and cryptocurrencies.

In this episode, we dive into the economics of (crypto)tokens: What is a token, how to value tokens, and how tokenomics is built in crypto projects?

Matthias answers these and other questions in our call using numerous practical examples.

To the podcast (in German): Tokenomics - Die ökonomische Theorie hinter den Tokens – X goes Future Podcast | Podcast auf Spotify

Matthias Hafner participates in a panel discussion about the future of centralized and decentralized finance at the Blockchain Forum Italy.

Matthias Hafner was invited to speak at the Blockchain Forum Italy in Mailand. Together with Massimo Morini, Chief Economist Algorand Foundation, Michele Treccani, Head of Market Analytics & Research Algorand Foundation, and Benedetto Biondi, CEO of Folks Finance he will discuss in a panel the future of centralized and decentralized finance ("From CeFi to DeFi").

More about the Blockchain Forum Italy.

The Center for Cryptoeconomics partners with proof-of-stake Blockchain Algorand.

The Center for Cryptoeconomics joins the Partner Program to intensify its services in the Algorand ecosystem. Algorand is a pure proof-of-stake blockchain focused on the convergence between decentralized and traditional finance. A perfect match for cryptecon with its strong expertise in tokenomics and protocol design for DeFi projects. Previously, cryptecon already advised several Algorand projects such as Folks Finance and Pact. We are now looking forward to intensifying our efforts on Algorand and providing our services as a Preferred Partner.

Algorand creates a green Blockchain with strong focus on efficiency and is the exclusive Blockchain of FIFA’s Men’s World Cup 2022 and official Sponsor of FIFA’s Women’s World Cup 2023.

More about Algorand.

Pact creates a decentralized exchange (DEX) for crypto assets on the Algorand Blockchain. The Center for Cryptoeconomics supports Pact to design its tokenomics and protocol incentives.

We support Pact designing its exchange with different services:

- cryptecon works with Pact to determine its tokenomics, i.e. the management, allocation, and distribution of its native token

- cryptecon assists Pact in the design of the reward and staking program

- cryptecon supports Pact to find a tamper-proof valuation formula for its liquidity pool tokens (fair LP token pricing formula)

We apply the following methods:

- Simulation of the tokenomic model to validate the overall design and propose and test parameters

- Econometric methods and data analyses of other DEX for parameter calibration

- Research and analytical methods to determine a fair pricing formula for LP tokens

Cryptecon is pleased to announce a strategic partnership with Folks Finance – a lending protocol on the Algorand Blockchain. Cryptecon will review the economic model of the protocol.

Folks Finance is preparing for its launch by performing all the necessary reviews, audits, and soon, the testnet. Runtime Verification Inc and two more professional auditors have been engaged to conduct the protocol security audit. The team will soon announce more details regarding the results of the audits.

On the economic side, Folks Finance is collaborating with cryptecon's industry specialists to conduct analysis, research, and simulations of the various economic parameters. In particular, the safety margins S1, S2, S3, the optimal Utilization Ratio, and the overall soundness of the economic model have been reviewed and analyzed.

The collaboration will result in the publication of several collaborative research papers and a long-term partnership to ensure the best possible work on future protocol developments and updates. Anticipating the official publications, here are some highlights of the research work carried out by the companies:

(1) Folks Finance safety parameters are being set based on crypto pairs assumptions. In agreement with cryptecon, Folks Finance has concluded that it is safer to define the parameters S1, S2 and S3 based on pairs of tokens evaluating their market covariance, rather than only on the borrowed asset, as it is typically done in traditional lending protocols.

(2) The start-up of the new liquidity pools is a critical point of Lending protocols. The team has implemented an innovative liquidity provision and incentive system. This was reviewed by the Swiss company to ensure protocol stability and limit the rise of critical liquidity situations. Moreover, Folks Finance will require specific conditions for whitelisting a new asset.

(3) In order to test the protocol, cryptecon created a simulator (agent-based model) that reproduces the calculations of the protocol and simulates the actions of different agents. The simulator allows us to study the model’s behaviour during its regular use.

Folks Finance CEO Benedetto Biondi said:

"We are very pleased and excited to have partnered with cryptecon, one of the most established realities on economic consulting in crypto. Thanks to the collaboration and the continuous dedication, we have been able to improve the protocol making it more functional, reliable, and secure. During these months of work, we have had a lot of positive feedback, which has given rise to a long-term collaboration with the Swiss company, thanks to which we will be able to continue to have their support and know-how to ensure maximum performance in the future developments of Folks Finance".

Matthias Hafner, Director of cryptecon - Center for Cryptoeconomics - also said:

“We are delighted to announce the recently established partnership with Folks Finance. Previously, cryptecon has created an agent-based model for Folks Finance to simulate the behaviour of their protocol under different scenarios. It has always been a great pleasure to work with them, so we decided to extend it. This collaboration allows us to discuss and solve problems in-depth and find optimal protocol solutions. With the created simulation and the knowledge of both partners, we are confident to create a secure and profitable lending platform and thus contribute to the Algorand ecosystem.”

Cryptecon continues to support the CV Labs Incubation Program for start-ups using the Blockchain technology.

Recently, Juan Beccuti joined CV Labs as a mentor for the start-ups' incubation program. Together with Matthias Hafner (who joined CV Labs in 2019), he shares his expertise in platform and token economics. They present and discuss with the program's participants the main characteristics, considerations, and decisions to consider when designing token-based ecosystems.

In 2018 cryptecon supported Synthetix to launch a stablecoin. Today, Synthetix is one of the most prominent DeFi protocol offering different synthetic assets. Recently, cryptecon was asked to support Synthetix again to develop a decentralized futures contract.

The original concept is based on a dual-token system. Demand fluctuations for the stablecoin, named sUSD, are absorbed by a collateral coin, called SNX. Our previous analysis showed that under reasonable assumptions and parameters, SNX holders’ incentives are aligned with the system’s goal of exchange rate stability. Thus, SNX holders sell or buy sUSD depending on the prevailing valuation pressure in order to keep its value close to USD 1. The past three years have proven that the incentives are aligned, and synthetics can create coins that are stable in value.

Today, Synthetix plans to add perpetual futures to the ecosystem. Traders receive or pay a funding rate depending on whether there are more short or long positions open. This funding rate incentivizes traders and arbitrageurs to balance positions. In addition, some of the funds will be added to the debt pool to ensure the system's stability. Cryptecon supports Synthetix using mechanism design and simulation techniques to find the optimal design.

The Center for Cryptoeconomics is awarded with the Fintech Award "Best Economic Research & Consulting Services 2021 - Europe".

The award was hosted by Wealth & Finance International.

Polkadex builds a fully, decentralized, peer-to-peer, order book-based cryptocurrency exchange on the Polkadot network. Cryptecon supports Polkadex in designing the token economics and the automated market maker (AMM).

Recently, the exchange platform that is supported and funded by the Web3 Foundation launched its testnet. Polkadex is moving forward to launch the mainnet within the first half year of 2021.

The Swiss initiative aims to develop solutions for decentralizing and decarbonizing the supply of electrical power using distributed ledger technologies (DLT).

The Swiss DLT-for-Power initiative explores new digital avenues for electricity sources of the future. The first goal will be to foster a common understanding and lay groundwork. In phase two, the plan is to prepare a Swiss guideline (SNG) to ensure the compatibility and interoperability of various DLT applications in the system and to improve automation.

The World Economic Forum (WEF) attracted not only politicians, managers and scientists to Davos but also Blockchain experts, start-ups and investors. The Center for Cryptoeconomics was delighted to exchange views with them.

During the World Economic Forum (WEF), the incubation space provider of the largest Swiss Blockchain Venture Capitalist, CV Labs, organized several events in Davos designed to showcase and discuss the Blockchain ecosystem. Since Christian Jaag, Matthias Hafner and Jan Christoph Schlegel are mentoring start-ups from the CV Labs incubation program, we were happy to see them pitch and progress, and to exchange views about current topics in the Blockchain ecosystem. Discussions included successful projects, such as Synthetix, cryptecon supported in the past. CV VC proudly stated that there are now over 800 Blockchain companies in Switzerland and Lichtenstein. Cryptecon is looking forward to new exciting collaborations in the Blockchain industry.

Cryptecon supports the second incubation program of the largest investment ecosystem for start-ups using Blockchain technology in Zug, Switzerland (CV Labs Incubation Program).

Christian Jaag and Matthias Hafner recently met the start-ups and presented their expertise and experience in platform and monetary economics for token-based projects. In their workshop they discussed characteristics, considerations and decisions to be made when designing token-based ecosystems.

Christian Jaag gave the opening keynote at the CV summit Frankfurt which is part of this year’s Euro Finance Week.

He shared his thoughts on “Be your own bank? The role of financial institutions in a decentralized economy”.

Christian Jaag becomes an Advisor to the Centre for Evidence Based Blockchain (CEBB) and the Centre for Cryptoeconomics joins the CEEB as an institutional member.

CEBB is a neutral, independent and decentralised consortium of leading Blockchain research institutions.

Led by some of the world's most eminent academics, CEBB will devise scientific benchmarks and frameworks to support governments, businesses and policymakers in making evidence-based decisions. As a collective voice on the advancement of Evidence-Based blockchain, the academic "Think Tank" of thought leaders and researchers endeavours to establish internationally agreed standards on education, research and policy-making for blockchain technologies. CEBB will also support organisations in setting up regional and institutional EBB chapters, run by the CEBB Leads. CEBB will also assist with the advancement of high-quality research, call for papers and dissemination of scholarly content within the CEBB network. It will also facilitate joint initiatives, workshops, journal clubs, and other academic activities with CEBB members.

Christian Jaag spoke at the UPU World CEO Forum about Blockchain in the postal sector.

As digitalization takes hold and affects whole swathes of national economies, businesses need to adapt and innovate more rapidly than ever. In this context, blockchain and cryptographic technologies can be part of the answer. Yet, there are several possible elements to innovation in this area. An increasingly popular idea is to have start-ups develop the innovations that postal operators will later apply to their business processes. Christian Jaag had an Interesting discussion with Moses Ma, Derek Osborn and the world's postal CEOs about how they have considered and/or applied blockchain innovations in the international postal sector, including through partnerships with start-ups.

The Center for Cryptoeconomics is awarded with the Fintech Award "Best Economic Research & Consulting Services 2019 - Europe" hosted by Wealth & Finance International.

To the Award

The Center for Cryptoeconomics is happy to announce the new collaboration with CV VC, a Swiss venture capital company for start-ups using Blockchain technology.

The Center for Cryptoeconomics collaborates with CV VC, the largest investment ecosystem for start-ups using Blockchain technology in Zug, Switzerland. Cryptecon mentors the participants of the CV Labs Incubation Program. The first edition of the program is now ongoing. Out of 500 applications from 35 countries, 12 startups were selected to participate in the program.

Christian Jaag and Matthias Hafner met the start-ups and presented their expertise and experience in platform and monetary economics for token-based projects. They presented the most important characteristics, considerations and decisions to be made when designing token-based ecosystems.

The Center for Cryptoeconomics is nominated for the Fintech Awards hosted by Wealth & Finance.

The Fintech Awards, hosted by Wealth & Finance for the third consecutive year, are dedicated to rewarding and recognising the hard work, excellence and creativity of FinTech companies, start-ups, technologies and products.

The Center for Cryptoeconomics got recently informed about their nomination by a third party.

New paper on “The Bitcoin Mining Game: On the Optimality of Honesty in Proof-of-work Consensus Mechanism” by Juan Beccuti and Christian Jaag.

We consider a game in which Bitcoin miners compete for a reward of each solved puzzle in a sequence of them. We model it as a sequential game with imperfect information, in which miners have to choose whether or not to report their success. We show that the game has a multiplicity of equilibria and we analyze the parameter constellations for each of them. In particular, the minimum requirement to find it optimal not to report is decreasing with the number of miners who are not reporting, and increasing the heterogeneity among players reduces the likelihood that they choose not to report.

The Center for Cryptoeconomics supports Enovy in designing their Token Economics.

Envoy has invented a new way of networking which allows individual- and corporate users to manage their contact data from different sources (such as LinkedIn, Xing, Outlook, smartphones) in one place, based on an innovative use of blockchain technology.

This new concept is built on a paradox – sharing contact data while keeping it private.

Envoy enables users for the first time to gain monetary rewards with their networks by commoditizing (converting the data into an asset of value) and democratizing (sharing valuable relationships) their contact data.

Envoy operates in a private and secure environment in which users retain absolute control over the data they share, with whom they share it and for how long.

Cryptecon analyses the interplay between different token supply mechanisms, inflation and real demand for Envoy’s services.

Cryptecon supported the Havven Foundation designing the token system with game theoretical models and numerical simulations.

The Havven Foundation successfully launched a stablecoin (i.e. a price-stable cryptocurrency) on June 11, 2018. During the preceding ICO, the organization raised USD 30 million in funding.

The concept is based on a dual-token system. Demand fluctuations for the stablecoin, named Nomin, are absorbed by a collateral coin, named Havven. Our analysis shows that under reasonable assumptions and parameters, Havven holders’ incentives are aligned with the system’s goal of exchange rate stability. Thus, Havven holders sell or buy Nomins depending on the prevailing valuation pressure in order to keep its value close to USD 1.

“After months of hard work, both Havven and cryptecon were confident that the supply side incentives we had designed would enable the system to stabilise the Nomin price. At this point, cryptecon had begun an independent analysis of Havven. They developed a game theoretic model to determine whether actors in the system would follow the incentives. They also conducted simulations to understand how resilient the system would be to exogenous shocks.” Havven

A summary of the token design and the contributions of cryptecon can be found on the Havven(Synthetix) blog.

The Center for Cryptoeconomics supports Spot in designing their platform.

Spot aims to create a new decentralized economy for online news. Based on blockchain technology, the system is designed to align the incentives of writers, publishers, and readers by rewarding the distribution and promotion of valuable news. With the collapse of advertising revenues and the rise of fake news and clickbait, Spot hopes to become a valuable alternative for the distribution of quality content.

cryptecon advises Spot in designing its system using insights from platform and network economics.

A lecture by Christian Jaag.

A report for the Office of Inspector General of the United States Postal Service.

Swiss Economics has supported the Office of Inspector General of the United States Postal Service in a study that explores the possibilities of Blockchain technology for the USPS and other postal operators.

We accept payments and offer to pay salaries in Bitcoin.

Starting from now, we accept Bitcoin as payment for our consulting services. We also offer our employess the option to receive their salary (or a part of it) in Bitcoin.

Presentation of the research paper on «The Effect of Payment Reversibility on E-commerce and Postal Quality».

Christian Jaag presented the research paper «The Effect of Payment Reversibility on E-commerce and Postal Quality» at the eighth bi-annual postal economics conference of the Toulouse School of Economics. The Irreversibility of payments in virtual currencies shifts the risk of e-commerce from merchants to consumers. Under certain conditions, this strengthens online retailers in competition with brick-and-mortar stores as well as incentives for postal quality.

Contribution to the webinar on “Virtual currencies: Exploring a Potential Role for Postal Operators».

Our latest Swiss Economics update elaborates on the opportunities virtual currencies present to the postal sector.

Virtual currencies like Bitcoin are progressively gaining in popularity. However, limited availability still preempts their broad usage. Postal operators with their spatially comprehensive physical presence could play a key role in providing easy, quick and nationwide access to these alternative currencies. The postal network thus constitutes a natural bridge between the virtual and the physical worlds.

Will stablecoins disrupt or integrate with traditional payment systems?

Matthias Hafner's presentation on May 23, 2025 at the ETHBratislava 2025 conference, explored the evolving relationship between stablecoins and established payment giants like Mastercard and Visa. The talk examined whether stablecoins will eventually replace these networks, or if a more integrated future awaits.

It delved into the complexities of current payment schemes and highlighted how stablecoins offer a simpler transaction flow, while also discussing the existing challenges and potential for future disruption or integration within the financial landscape.

You can find the presentation here.

Last week, the Center for Cryptoeconomics had the privilege of attending EthereumZürich Conference 2025!

We presented our latest research on the Ethereum staking market, hosted a booth (complete with mulled wine), attended many interesting talks, and had insightful discussions with both familiar and new faces from the community.

In their talk, Matthias Hafner and Nicolas Oderbolz, explored how different forms of staking—solo staking, liquid staking, and staking via centralized exchanges—may be affected by a reduction in Ethereum protocol issuance. By analyzing their revenue sources and cost structures and integrating these insights into a formal model, we aim to contribute to the ongoing discussion on the future development of the Ethereum staking protocol. More to come!

You can find the presentation here.

The paper "The Four Types of Stablecoins: A Comparative Analysis" has been accepted and published in Ledger Journal.

The publication titled "The Four Types of Stablecoins: A Comparative Analysis" by Matthias Hafner, Marco Henriques Pereira, Helmut Dietl and Juan Beccuti has recently been published in Ledger Journal.

Abstract: Stablecoins have gained significant popularity recently, with their market cap rising to over $180 billion. However, recent events have raised concerns about their stability. In this paper, we classify stablecoins into four types based on the source and management of collateral and investigate the stability of each type under different conditions. We highlight each type’s potential instabilities and underlying tradeoffs using agent-based simulations. The results emphasize the importance of carefully evaluating the origin of a stablecoin’s collateral and its collateral management mechanism to ensure stability and minimize risks. Enhanced understanding of stablecoins should be informative to regulators, policymakers, and investors alike.

The paper is freely accessible at Ledger.

Nicolas Greber and Dr. Nicolas Eschenbaum gave a presentation on how arbitrageurs can exploit forks on DAOs and presented possible solutions to the problem.

At the CV Summit 2024, Nicolas Eschenbaum and Nicolas Greber presented possible strategies for DAOs in dealing with arbitrage in decentralised organisations based on their research. Using the example of the Noun DAO, they showed how the introduction of a forking mechanism -intended as a contribution to decentralisation and protection against majority attacks- instead opened up an arbitrage opportunity for speculators. Governance mechanisms that allow members of a DAO indirect access to the treasury harbour significant risks. For the specific example of the Nouns DAO, Nicolas Eschenbaum and Nicolas Greber presented possible solutions and their challenges to prevent speculators from participating in the DAO.

You can find the presentation here.

A new publication is available now at arxiv.org.

The publication titled Towards an Optimal Staking Design: Balancing Security, User Growth, and Token Appreciation by Nicolas Oderbolz, Matthias Hafner and Beatrix Marosvölgyi has recently been published in the ChainScience Conference Proceedings.

This paper examines the economic and security implications of Proof-of-Stake (POS) designs, providing a survey of POS design choices and their underlying economic principles in prominent POS-blockchains. The paper argues that POS-blockchains are essentially platforms that connect three groups of agents: users, validators, and investors. To meet the needs of these groups, blockchains must balance trade-offs between security, user adoption, and investment into the protocol.

The authors focus on the security aspect and identify two different strategies: increasing the quality of validators (static security) vs. increasing the quantity of stakes (dynamic security). They find, that the optimal staking design hinges upon a platform's specific objectives and its developmental stage. This research compels blockchain developers to meticulously assess the trade-offs outlined in this paper when developing their staking designs.

The whole paper can be accessed at the webpage of the Conference Proceedings or here.

The Center for Cryptoeconomics receives a research grant through the cyber.Fund MVI Grants Program.

In order to limit the growth of stakes in the Ethereum ecosystem to inefficiently high levels, recent discussions in the community have focused on the idea of changing the Ethereum issuance curve. However, the potential secondary effects of such a change are underexplored. In particular, a reduction in staking rewards may risk undermining the degree of decentralization of the Ethereum validator set. The research team at the Center for Cryptoeconomics aims to provide some clarity in this regard. We do so by evaluating the potential effects that changes in the issuance curve may have on different types of stakers, in particular solo stakers.

You can find the grant announcement of cyber.fund and a more detailed description here.

Beatrix Marosvölgyi and Matthias Hafner delivered a joint presentation discussing the sustainability journey of Ethereum. The title of their presentation: The Green Evolution of Ethereum.

The presentation focused on how Ethereum has reduced its energy consumption and carbon footprint, also considering the impact of the latest Dencun upgrade. In addition, the presentation explained the methodology used to assess the environmental impact of products and services (Life Cycle Assessment) and gave an outlook on what else could be improved on Ethereum in the future from a sustainability perspective.

You can find the presentation slides here and the video of the presentation here.

In his presentation titled "Next-Gen Payments: Competition among Stablecoins, CBDCs, and other Payment Tokens", Matthias Hafner discussed the competition that is developing between various upcoming digital payment methods, including stablecoins and central bank digital currencies (CBDCs).

His talk explored three key areas: 1) the current landscape of value transfer using low-volatility assets and the motivations behind such transactions; 2) emerging methods and motivations for value transfer on Ethereum; and 3) an examination of future value transfer mechanisms through the lens of competition economics, considering the evolving roles of stablecoins, CBDCs, and real-world assets.

You can find the presentation slides here and the video of the presentation here.

Nicolas Oderbolz presented the paper "Towards an Optimal Staking Design: Balancing Security, User Growth, and Token Appreciation", which he wrote with co-authors, Matthias Hafner and Beatrix Marosvölgyi.

The paper explores the economic and security aspects of Proof-of-Stake (POS) designs, focusing on the balance between security, user adoption, and investment. It identifies a trade-off between enhancing the quality of validators and increasing the quantity of stakes, suggesting that the optimal POS system design depends on a blockchain's specific objectives and developmental stage.

Link to the slides: Towards an Optimal Staking Design Presentation

In a series of blog post we discuss and compare the different versions of the decentralized exchange platform, Uniswap.

In the first blog post, our Expert fellow, Thunj Chantramonklasri explains the basic terms in connection with Uniswap's design, to be able to build on these terms in his upcoming articles. He also elaborates on the mathematical background of the impermanent loss problem.

You can find the whole publication and our Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Matthias Hafner presented his research on the impact of arbitrageurs on decentralized exchanges at the Research Track of the Crypto Finance Conference in St. Moritz.

Matthias presented his research paper "Impermanent Loss Conditions: An Analysis of Decentralized Exchange Platforms".

Abstract: Decentralized exchanges are widely used platforms for trading crypto assets. The most common types work with automated market makers (AMM), allowing traders to exchange assets without needing to find matching counterparties. Thereby, traders exchange against asset reserves managed by smart contracts. These assets are provided by liquidity providers in exchange for a fee. Static analysis shows that small price changes in one of the assets can result in losses for liquidity providers. Despite the success of AMMs, it is claimed that liquidity providers often suffer losses. However, the literature does not adequately consider the dynamic effects of fees over time. Therefore, we investigate the impermanent loss problem in a dynamic setting using Monte Carlo simulations. Our findings indicate that price changes do not necessarily lead to losses. Fees paid by traders and arbitrageurs are equally important. In this respect, we can show that an arbitrage-friendly environment benefits the liquidity provider. Thus, we suggest that AMM developers should promote an arbitrage-friendly environment rather than trying to prevent arbitrage.

Find the paper here.

In our next blog post, we explore some potential use cases of blockchain and AI in the aviation industry.

The continuous developments in blockchain and artificial intelligence enable users to apply these technologies in versatile ways across various industries. In this article, we examine the potential of both technologies in four aviation-related areas: ground operations, customer-related activities, maintenance, repair, and overhaul activities (MRO), and airport infrastructure-related services. We showcase, through a handful of real-life examples, how these technologies can not only increase efficiency but also reduce costs and enhance the travel experience.

You can find the whole publication and our Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

In this final blog post in our series on crypto staking, we summarize and comment on our findings and discuss the economic trade-offs of different staking policy choices.

This blog post is the last of our Crypto-Staking Blog Series. We summarize and comment on our findings and discuss the economic trade-offs of different staking policy choices. You can find the first post on the economics of crypto staking here and the second post, with an economic comparison of staking across blockchains, here. You can find the whole publication and our Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Our paper on DeFi lending risks, authored by Alberto Arrigoni, Benedetto Biondi, Nicolas Greber, Matthias Hafner, Gidon Katten, Romain de Luze, Michelangelo Riccobene, and Juan Ignacio Beccuti Vazquez was called as one of the best papers in 2023, published in the Journal of British Blockchain Association.

We are delighted that the paper has received this award from The British Blockchain Association! This recognition is a testament to the hard work, dedication and expertise of the author team from Folks Finance and the Center for Cryptoeconomics. According to the British Blockchain Association, papers with the following characteristics are rewarded:

- Likely to influence future thinking

- Have made, or have the potential to make a significant contribution to the DLT/ Blockchain or Cryptocurrencies ecosystem, as measured by scholarly and societal impact metrics, downloads, article views, engagement on social media (Alternative metrics) or citation in policy documents

- Are cited or have the potential to be cited at high-impact conferences and events, or referenced or quoted by policymakers, influencers or thought-leaders in the field

You can read the paper here and find more about the British Blockchain Association here.

The TRUST SQUARE in Zurich hosted an exciting evening of discussion and learning centered around decentralized autonomous organizations (DAOs). The event, co-organized by DAO Suisse, featured an insightful presentation on DAO Economics by the Cryptecon team.

Cryptecon team members Nicolas Eschenbaum, Beatrix Marosvölgyi, and Nicolas Oderbolz shared their insights on tokenomics and platform economics. Their presentation ignited a thought-provoking discussion with attendees, delving into the potential and challenges facing this innovative organizational model.

The collaborative atmosphere, fueled by Cryptecon's expertise, highlights a growing interest in the potential of DAOs to transform how we work and organize.

Swiss Economics and the Center for Cryptoeconomics conducted a survey on IP and Blockchain for the Swiss Federal Institute of Intellectual Property. The results are now published.

Intellectual property, such as patent rights or copyrights, protects inventors from free riders and, as a result, creates incentives to invest more in research and development as well as in creative works. IP is also relevant in the rapidly evolving field of blockchain technology and its applications. Through our study, the IPI aimed to gain a better understanding of the current and, above all, the future demand for IP services. A similar country-specific study is currently underway in Singapore and will be published later.

The study's findings will be presented by Matthias Hafner and Delia Horst (representative of the IPI) on October 3rd at the CV Summit event in Zug.

Authors: Dr. Samuel Rutz, Matthias Hafner, Felix Wüthrich, Beatrix Marosvölgyi

You can find our study published on the IPI website here (only available in EN).

We are happy to announce a new collaboration between the Center for Cryptoeconomics and the Consensus Group Australia.

Our partnership with Consensus Group Australia and CEO Nathan van den Bosch, who is a Blockchain Expert and Behavioral Economist aims to foster a strong relationship, where both entities can join forces to share their skills and expertise. We welcome Nathan’s valuable skills and expertise to our organization.

More about the Consensus Group Australia

More about Nathan Van den Bosch

In a recent presentation at the Blockchance conference in Hamburg, Matthias Hafner explored the factors that influence the stability of stablecoins and discussed how they relate to recent developments in CBDCs and the tokenization of real-world assets.

Drawing from recent literature, including his own research conducted at the University of Zurich, Matthias Hafner emphasized that the construction and management of collateral are key determinants of stablecoin stability. While externally derived collateral value may compromise the independence of the stablecoin ecosystem, collateral value derived from within the ecosystem carries the risk of death spirals, as observed with TerraUSD. Additionally, centralized management may offer cost-effectiveness but exposes the stablecoin ecosystem to the risk of bank runs, as exemplified by the recent USDC depeg incident.

Further, Matthias Hafner argued that the advent of CBDCs and tokenized real-world assets could potentially put pressure on the demand for stablecoins in the future. This could, for example, result in the need to introduce solutions for stablecoins that offer interest payments based on their underlying collateral.

More detailed information can be found here:

Blockchance presentation slides

Matthias Hafners research on stablecoins

We are pleased to announce that Nicolas Oderbolz has been promoted to the position of Economist.

Nicolas Oderbolz has joined Swiss Economics and the Center for Cryptoeconomics as an Economist with a focus on regulation, health and blockchain. He is involved in various projects in the fields of energy, data analytics and cryptoassets.

Nicolas completed his Bachelor and Master studies in Economics at the University of Zurich, with a focus on empirical methods and data analysis. During his studies, he worked as a research assistant at the University of Zurich in the field of labour and development economics. He has been a valuable part of the Swiss Economics team since the summer of 2022.

We congratulate him and wish him much success and joy in his new activities for Swiss Economics and for the Center for Cryptoeconomics.

The article "Blockchain und ihre Anwendungen" by Matthias Hafner and Dr. Christian Jaag was recently published in the quarterly issue of the zsis) Centre for Swiss and International Tax Law.

In their contribution, they explain how blockchain works through illustrative examples and use cases. In addition, they explain the legal classification of crypto-assets and show the limits of the technology.

The publication can be accessed here.

A new collaboration has been established between the Center for Cryptoeconomics and the team of the Raremind platform to connect Web2 chess players with a Web3 gaming experience.

The Center for Cryptoeconomics collaborates with the team of Raremind to create a Web3 platform, that can be connected with Web2 chess platforms, to utilize points earned on the platforms in the form of crypto-rewards and real-world rewards. The Play-to-Earn platform is not only a bridge between existing online chess-platforms, but it will also offer a Learn-to-Earn mode and Fantasy Leagues, to predict the outcomes of real-world chess tournaments. The Center for Cryptoeconomics assists the project and reviews the creators' most important tokenomic decisions.

To access the platform and join their upcoming tournaments, click here:

raremind.com

Matthias Hafner presented his research on stablecoins at the Wolfram ChainScience conference in Boston, USA.

The article, "The Four Types of Stablecoins: A Comparative Analysis" (jointly with Marco Henriques Pereira, Prof. Dr. Helmut Dietl, and Juan Beccuti) discusses the conditions under which stablecoins may lose their value. Among others, they explore the crash of Terra and the de- and re-peg of the USDC stablecoin.

Link to the slides: The Four Types of Stablecoins (swiss-economics.ch)

The Center for Cryptoeconomics has partnered with CADLabs and Bumper to evaluate the Bumper DeFi Protocol. We are excited to announce that our findings have now been published in the Bumper Simulation Report.

The simulations conducted as part of the collaborative research effort were able to validate the design of the Bumper protocol. The findings highlight that Bumper provides more affordable premiums and superior returns when compared to similar offerings. Further, we demonstrate Bumper's capacity to sustain solvency and generate revenue from administering usage fees.

You can find the publication here.

Matthias Hafner was awarded 1st place at The British Blockchain Association for their research on Stablecoin (joint work with Prof. Helmut Dietl)

In this research, the authors explained the recent depeg of the second largest stablecoin USDC and under what conditions stablecoins could lose their value.

The slides can be found here: The Four Types of Stablecoins: A Comparative Analysis.

In less than a week, the Shanghai-update will be implemented on the Ethereum Beacon Chain. In a series of blog post we discuss and compare staking designs of different blockchains.

In our second blog post of this series, we analyze and compare the staking designs of different blockchains from an economic perspective. To make the information more accessible and compact, we also created a table which can serve as a quick reference.

You can find the whole publication and our new Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Matthias Hafner and Nicolas Greber were awarded first and third place at BBA's 5th Scientific Conference for their research presentations.

Matthias Hafner and Nicolas Greber, two of our blockchain researchers, have made their mark at BBA's 5th Scientific Conference, with first and third place awards for their research presentations.

Matthias explained the recent depeg of the second largest stablecoin USDC and under what conditions stablecoins could lose their value. The paper and slides were created in collaboration with Marco Henriques Pereira, Juan Beccuti and Helmut Dietl.

Nicolas proposed mechanisms for handling liquidity risk using the DeFi lending platform Folks Finance. The paper and slides are the result of joint work with Matthias Hafner, Romain de Luze, Juan Becutti, Benedetto Biondi, Gidon Katten, Michelangelo Riccobene, and Alberto Arrigoni.

More about the British Blockchain Association.

In light of the Shanghai update of the Ethereum blockchain, which allows stakers to unstake their ETH, we find it timely to investigate crypto staking in a series of upcoming blog posts.

In our first blog post, we explain the basic terms, economics and mechanisms of staking designs. Later, we compare the staking designs of seven different blockchains.

You can find the whole publication and our new Company Profile on Medium.

Don't hesitate to follow us there to stay updated on our upcoming publications!

Matthias Hafner was featured on an episode of the X goes Crypto podcast. In the podcast, he delves into the topic of tokenomics, sharing his expert insights and analysis on the current state of the industry.

In this X goes Future Talk episode, Fabian from X goes Crypto interviews Matthias Hafner, an expert in the crypto space for years and also Director of the Center for Cryptoeconomics from Switzerland. The Center for Cryptoeconomics provides economic research and consulting services related to blockchain technology and cryptocurrencies.

In this episode, we dive into the economics of (crypto)tokens: What is a token, how to value tokens, and how tokenomics is built in crypto projects?

Matthias answers these and other questions in our call using numerous practical examples.

To the podcast (in German): Tokenomics - Die ökonomische Theorie hinter den Tokens – X goes Future Podcast | Podcast auf Spotify

Matthias Hafner participates in a panel discussion about the future of centralized and decentralized finance at the Blockchain Forum Italy.

Matthias Hafner was invited to speak at the Blockchain Forum Italy in Mailand. Together with Massimo Morini, Chief Economist Algorand Foundation, Michele Treccani, Head of Market Analytics & Research Algorand Foundation, and Benedetto Biondi, CEO of Folks Finance he will discuss in a panel the future of centralized and decentralized finance ("From CeFi to DeFi").

More about the Blockchain Forum Italy.

The Center for Cryptoeconomics partners with proof-of-stake Blockchain Algorand.

The Center for Cryptoeconomics joins the Partner Program to intensify its services in the Algorand ecosystem. Algorand is a pure proof-of-stake blockchain focused on the convergence between decentralized and traditional finance. A perfect match for cryptecon with its strong expertise in tokenomics and protocol design for DeFi projects. Previously, cryptecon already advised several Algorand projects such as Folks Finance and Pact. We are now looking forward to intensifying our efforts on Algorand and providing our services as a Preferred Partner.

Algorand creates a green Blockchain with strong focus on efficiency and is the exclusive Blockchain of FIFA’s Men’s World Cup 2022 and official Sponsor of FIFA’s Women’s World Cup 2023.

More about Algorand.

Pact creates a decentralized exchange (DEX) for crypto assets on the Algorand Blockchain. The Center for Cryptoeconomics supports Pact to design its tokenomics and protocol incentives.

We support Pact designing its exchange with different services:

- cryptecon works with Pact to determine its tokenomics, i.e. the management, allocation, and distribution of its native token

- cryptecon assists Pact in the design of the reward and staking program

- cryptecon supports Pact to find a tamper-proof valuation formula for its liquidity pool tokens (fair LP token pricing formula)

We apply the following methods:

- Simulation of the tokenomic model to validate the overall design and propose and test parameters

- Econometric methods and data analyses of other DEX for parameter calibration

- Research and analytical methods to determine a fair pricing formula for LP tokens

Cryptecon is pleased to announce a strategic partnership with Folks Finance – a lending protocol on the Algorand Blockchain. Cryptecon will review the economic model of the protocol.

Folks Finance is preparing for its launch by performing all the necessary reviews, audits, and soon, the testnet. Runtime Verification Inc and two more professional auditors have been engaged to conduct the protocol security audit. The team will soon announce more details regarding the results of the audits.

On the economic side, Folks Finance is collaborating with cryptecon's industry specialists to conduct analysis, research, and simulations of the various economic parameters. In particular, the safety margins S1, S2, S3, the optimal Utilization Ratio, and the overall soundness of the economic model have been reviewed and analyzed.

The collaboration will result in the publication of several collaborative research papers and a long-term partnership to ensure the best possible work on future protocol developments and updates. Anticipating the official publications, here are some highlights of the research work carried out by the companies:

(1) Folks Finance safety parameters are being set based on crypto pairs assumptions. In agreement with cryptecon, Folks Finance has concluded that it is safer to define the parameters S1, S2 and S3 based on pairs of tokens evaluating their market covariance, rather than only on the borrowed asset, as it is typically done in traditional lending protocols.

(2) The start-up of the new liquidity pools is a critical point of Lending protocols. The team has implemented an innovative liquidity provision and incentive system. This was reviewed by the Swiss company to ensure protocol stability and limit the rise of critical liquidity situations. Moreover, Folks Finance will require specific conditions for whitelisting a new asset.

(3) In order to test the protocol, cryptecon created a simulator (agent-based model) that reproduces the calculations of the protocol and simulates the actions of different agents. The simulator allows us to study the model’s behaviour during its regular use.

Folks Finance CEO Benedetto Biondi said:

"We are very pleased and excited to have partnered with cryptecon, one of the most established realities on economic consulting in crypto. Thanks to the collaboration and the continuous dedication, we have been able to improve the protocol making it more functional, reliable, and secure. During these months of work, we have had a lot of positive feedback, which has given rise to a long-term collaboration with the Swiss company, thanks to which we will be able to continue to have their support and know-how to ensure maximum performance in the future developments of Folks Finance".

Matthias Hafner, Director of cryptecon - Center for Cryptoeconomics - also said:

“We are delighted to announce the recently established partnership with Folks Finance. Previously, cryptecon has created an agent-based model for Folks Finance to simulate the behaviour of their protocol under different scenarios. It has always been a great pleasure to work with them, so we decided to extend it. This collaboration allows us to discuss and solve problems in-depth and find optimal protocol solutions. With the created simulation and the knowledge of both partners, we are confident to create a secure and profitable lending platform and thus contribute to the Algorand ecosystem.”

Cryptecon continues to support the CV Labs Incubation Program for start-ups using the Blockchain technology.

Recently, Juan Beccuti joined CV Labs as a mentor for the start-ups' incubation program. Together with Matthias Hafner (who joined CV Labs in 2019), he shares his expertise in platform and token economics. They present and discuss with the program's participants the main characteristics, considerations, and decisions to consider when designing token-based ecosystems.

In 2018 cryptecon supported Synthetix to launch a stablecoin. Today, Synthetix is one of the most prominent DeFi protocol offering different synthetic assets. Recently, cryptecon was asked to support Synthetix again to develop a decentralized futures contract.

The original concept is based on a dual-token system. Demand fluctuations for the stablecoin, named sUSD, are absorbed by a collateral coin, called SNX. Our previous analysis showed that under reasonable assumptions and parameters, SNX holders’ incentives are aligned with the system’s goal of exchange rate stability. Thus, SNX holders sell or buy sUSD depending on the prevailing valuation pressure in order to keep its value close to USD 1. The past three years have proven that the incentives are aligned, and synthetics can create coins that are stable in value.

Today, Synthetix plans to add perpetual futures to the ecosystem. Traders receive or pay a funding rate depending on whether there are more short or long positions open. This funding rate incentivizes traders and arbitrageurs to balance positions. In addition, some of the funds will be added to the debt pool to ensure the system's stability. Cryptecon supports Synthetix using mechanism design and simulation techniques to find the optimal design.

The Center for Cryptoeconomics is awarded with the Fintech Award "Best Economic Research & Consulting Services 2021 - Europe".

The award was hosted by Wealth & Finance International.

Polkadex builds a fully, decentralized, peer-to-peer, order book-based cryptocurrency exchange on the Polkadot network. Cryptecon supports Polkadex in designing the token economics and the automated market maker (AMM).

Recently, the exchange platform that is supported and funded by the Web3 Foundation launched its testnet. Polkadex is moving forward to launch the mainnet within the first half year of 2021.

The Swiss initiative aims to develop solutions for decentralizing and decarbonizing the supply of electrical power using distributed ledger technologies (DLT).

The Swiss DLT-for-Power initiative explores new digital avenues for electricity sources of the future. The first goal will be to foster a common understanding and lay groundwork. In phase two, the plan is to prepare a Swiss guideline (SNG) to ensure the compatibility and interoperability of various DLT applications in the system and to improve automation.

The World Economic Forum (WEF) attracted not only politicians, managers and scientists to Davos but also Blockchain experts, start-ups and investors. The Center for Cryptoeconomics was delighted to exchange views with them.

During the World Economic Forum (WEF), the incubation space provider of the largest Swiss Blockchain Venture Capitalist, CV Labs, organized several events in Davos designed to showcase and discuss the Blockchain ecosystem. Since Christian Jaag, Matthias Hafner and Jan Christoph Schlegel are mentoring start-ups from the CV Labs incubation program, we were happy to see them pitch and progress, and to exchange views about current topics in the Blockchain ecosystem. Discussions included successful projects, such as Synthetix, cryptecon supported in the past. CV VC proudly stated that there are now over 800 Blockchain companies in Switzerland and Lichtenstein. Cryptecon is looking forward to new exciting collaborations in the Blockchain industry.

Cryptecon supports the second incubation program of the largest investment ecosystem for start-ups using Blockchain technology in Zug, Switzerland (CV Labs Incubation Program).

Christian Jaag and Matthias Hafner recently met the start-ups and presented their expertise and experience in platform and monetary economics for token-based projects. In their workshop they discussed characteristics, considerations and decisions to be made when designing token-based ecosystems.

Christian Jaag gave the opening keynote at the CV summit Frankfurt which is part of this year’s Euro Finance Week.

He shared his thoughts on “Be your own bank? The role of financial institutions in a decentralized economy”.

Christian Jaag becomes an Advisor to the Centre for Evidence Based Blockchain (CEBB) and the Centre for Cryptoeconomics joins the CEEB as an institutional member.

CEBB is a neutral, independent and decentralised consortium of leading Blockchain research institutions.

Led by some of the world's most eminent academics, CEBB will devise scientific benchmarks and frameworks to support governments, businesses and policymakers in making evidence-based decisions. As a collective voice on the advancement of Evidence-Based blockchain, the academic "Think Tank" of thought leaders and researchers endeavours to establish internationally agreed standards on education, research and policy-making for blockchain technologies. CEBB will also support organisations in setting up regional and institutional EBB chapters, run by the CEBB Leads. CEBB will also assist with the advancement of high-quality research, call for papers and dissemination of scholarly content within the CEBB network. It will also facilitate joint initiatives, workshops, journal clubs, and other academic activities with CEBB members.

Christian Jaag spoke at the UPU World CEO Forum about Blockchain in the postal sector.

As digitalization takes hold and affects whole swathes of national economies, businesses need to adapt and innovate more rapidly than ever. In this context, blockchain and cryptographic technologies can be part of the answer. Yet, there are several possible elements to innovation in this area. An increasingly popular idea is to have start-ups develop the innovations that postal operators will later apply to their business processes. Christian Jaag had an Interesting discussion with Moses Ma, Derek Osborn and the world's postal CEOs about how they have considered and/or applied blockchain innovations in the international postal sector, including through partnerships with start-ups.

The Center for Cryptoeconomics is awarded with the Fintech Award "Best Economic Research & Consulting Services 2019 - Europe" hosted by Wealth & Finance International.

To the Award

The Center for Cryptoeconomics is happy to announce the new collaboration with CV VC, a Swiss venture capital company for start-ups using Blockchain technology.

The Center for Cryptoeconomics collaborates with CV VC, the largest investment ecosystem for start-ups using Blockchain technology in Zug, Switzerland. Cryptecon mentors the participants of the CV Labs Incubation Program. The first edition of the program is now ongoing. Out of 500 applications from 35 countries, 12 startups were selected to participate in the program.

Christian Jaag and Matthias Hafner met the start-ups and presented their expertise and experience in platform and monetary economics for token-based projects. They presented the most important characteristics, considerations and decisions to be made when designing token-based ecosystems.

The Center for Cryptoeconomics is nominated for the Fintech Awards hosted by Wealth & Finance.

The Fintech Awards, hosted by Wealth & Finance for the third consecutive year, are dedicated to rewarding and recognising the hard work, excellence and creativity of FinTech companies, start-ups, technologies and products.

The Center for Cryptoeconomics got recently informed about their nomination by a third party.

New paper on “The Bitcoin Mining Game: On the Optimality of Honesty in Proof-of-work Consensus Mechanism” by Juan Beccuti and Christian Jaag.